Taxation of savings & investments in the UK

In the 2023/24 tax year, individuals now only have a £6,000 Capital Gains Tax allowance, down from £12,300 last year. Further, in the 2025/25 tax year it is due to be reduced to only £3,000.

Likewise the 2023/34 dividend allowance has been reduced to £1,000 and will reduce even further to £500 for the following tax year.

This means that a larger and larger portion of an investor's earnings will be taxed (at rates specific to their individual circumstances).

ISAs to the rescue?

An Individual Savings Account (ISA) has long been a tax-efficient way of handling your savings & investments.

Originally introduced in April 2016, there are now four types of ISA:

An investor may open up to one of each type in each tax year, and in the 2023/24 tax year may deposit up to £20,000 across them with a maximum of £4,000 in a Lifetime ISA (read more here). Earnings will be made at a (usually quite low) fixed or variable rate in a Cash ISA. The earnings in a Stocks & Shares ISA or IFISA will depend on the investment choices of the investor and the performance of the investments.

Earnings within an ISA account are tax-free in perpetuity so it is understandable that many investors are trying to make as much as possible of this yearly allowance.

Choosing an ISA

Many investors are not comfortable with the volatility of the stock market and will opt for the contractual Cash ISA rates or relative predictability of an IFISA. But the returns from these can differ greatly, particularly for the longer term saver or investor.

Let’s review some examples of how different earnings could look over five years in either a Cash ISA or, in this case, the LandlordInvest IFISA.

Investors with LandlordInvest have, on average, earned in excess of 10%* every year whilst suffering no capital loss. Please see our statistics section.

* Past performance is not a reliable indicator of future success.

Cash ISAs have over the last five years had very low returns and only recently passed 2% on average but for simplicity's sake we will imagine they’d been paying 2% for the entire period.

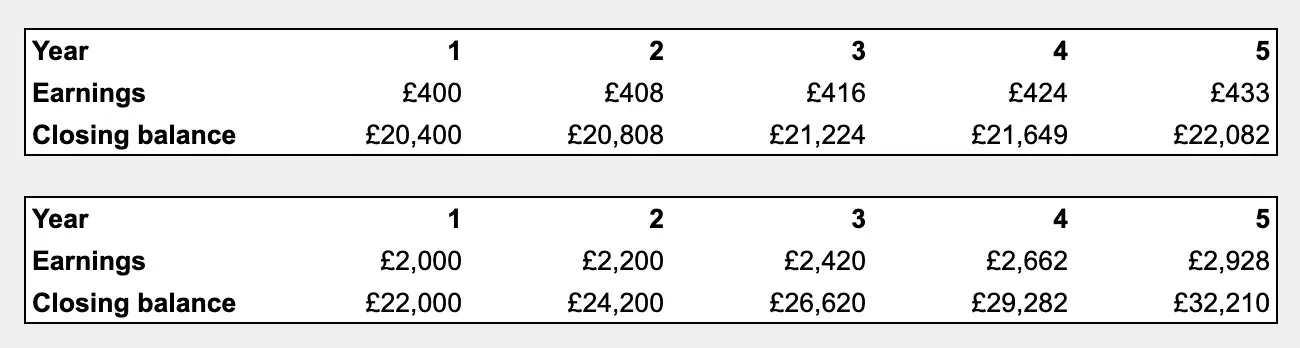

Example 1

The full yearly ISA allowance of £20,000 invested for five years in a Cash ISA and IFISA.

The IFISA closing balance in year five is over £10,000 larger than the Cash ISA. IFISA’s return is 61.05% over the five year period whilst the Cash ISA’s return is 10.41% over the same period.

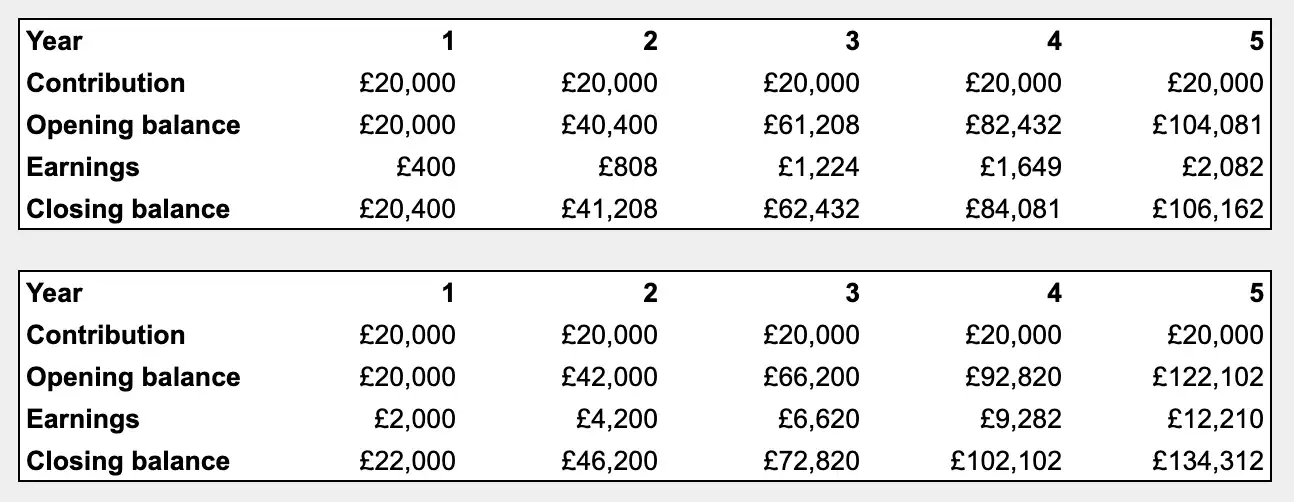

Example 2

The full yearly ISA allowance of £20,000 invested every year over a five year period in a Cash ISA and IFISA.

The IFISA closing balance in year five is over £28,000 larger than the Cash ISA with a gain of £13,321. IFISA’s return is 34.31% over the five year period whilst the Cash ISA’s return is 6.16% over the same period.

What does this mean in real terms?

In the real world, where an investor plans to one day spend some or all of their savings, we should also consider the reduction in the purchasing power of the savings due to inflation.

Given an example average inflation rate of 3% per year the closing balance for the Cash ISA in Example 2 would actually be -£3,135, an inflation adjusted loss. However, the IFISA in Example 2 would close with an inflation adjusted balance of £30,283.

Although keep in mind that higher returns also means higher risk.

Our blogs are for information purposes only. This content is not financial, legal or tax advice. Should you require any advice in relation to the earnings you make from LandlordInvest we recommend seeking independent professional advice. Links to other sites are provided for your convenience but LandlordInvest accepts no responsibility or liability for the content of those sites or of any external site. The information in this blog is correct at the time of posting.

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL