We’re currently putting the finishing touches to the secondary market, making some improvements to the user interface, and conducting a final review of our help text.

It will be launched a little later than we had originally planned, in the week beginning 22 May 2017. In the meantime, here’s a visual guide to what’s coming.

* Please note: all amounts, dates and other data are examples created during testing by LandlordInvest.

To list a loan part for sale

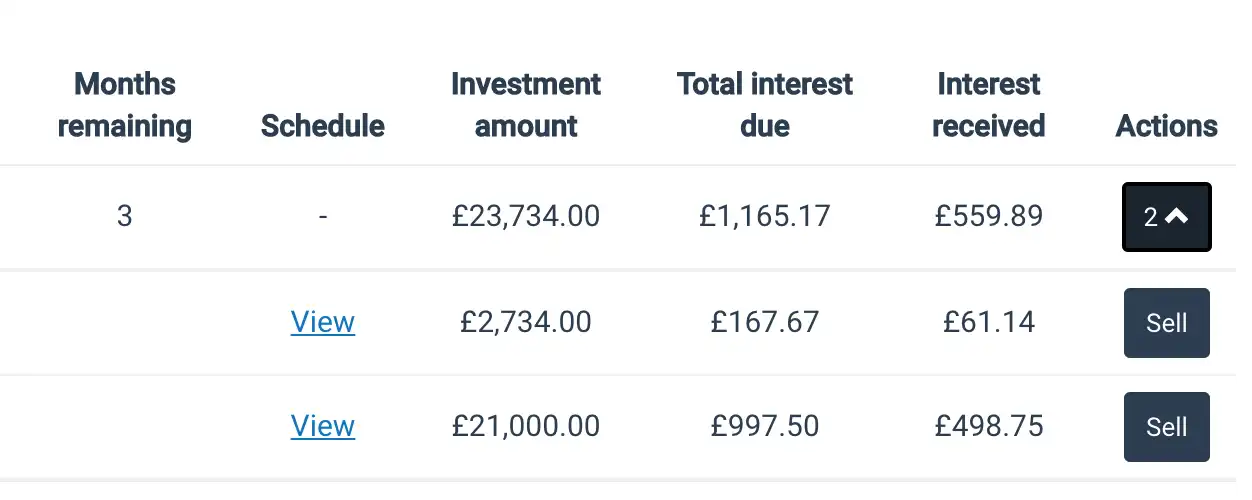

Visit the “My Investments” tab of your investor dashboard. Each loan part that can be sold will have a ‘Sell’ button. To qualify for sale on the secondary market, a loan part must be an investment in a healthy loan and have at least one interest payment remaining.

Click the sell button for the loan part you wish to list for sale.

Click the sell button for the loan part you wish to list for sale.

You can choose to either list the entire investment principal, or just a part of it.

After creating your listing, you can manage it by clicking ‘Sell’ again.

Here you can remove parts from the secondary market.

You may also create more listings, if you haven’t listed the whole principal of the loan yet.

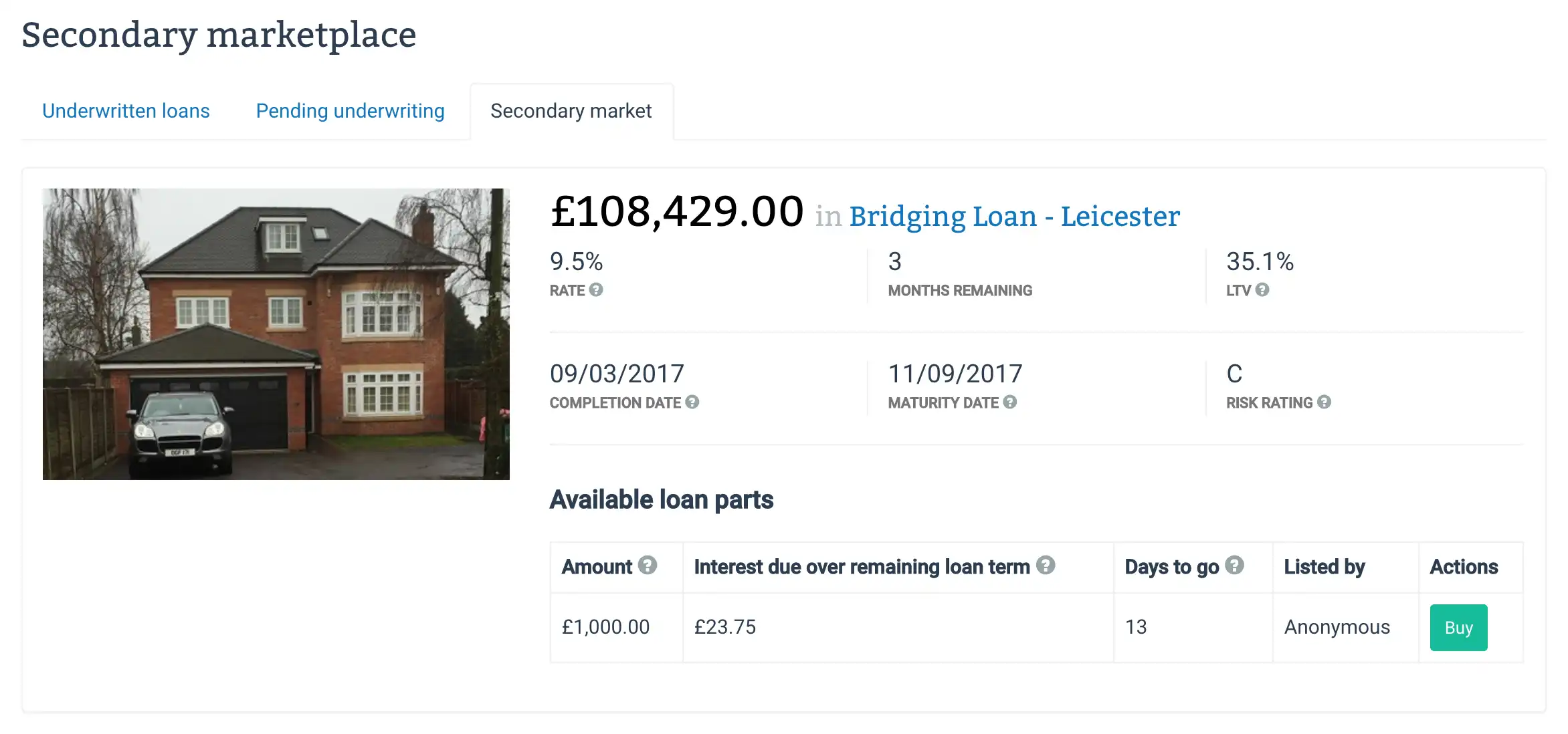

Once created, other investors will be able to find your listing in the secondary market. All listings will be grouped under an overview of the loan with which they are associated.

The title (in this case “Bridging Loan - Leicester”) can be clicked to view the original loan listing. There, investors may view the full detail of the loan, any previous updates or questions and replies, and ask new questions.

The title (in this case “Bridging Loan - Leicester”) can be clicked to view the original loan listing. There, investors may view the full detail of the loan, any previous updates or questions and replies, and ask new questions.

Investors wishing to buy a loan part may click the ‘Buy’ button, at which point the listing will be hidden from the secondary market while the administrator reviews and approves the transaction.

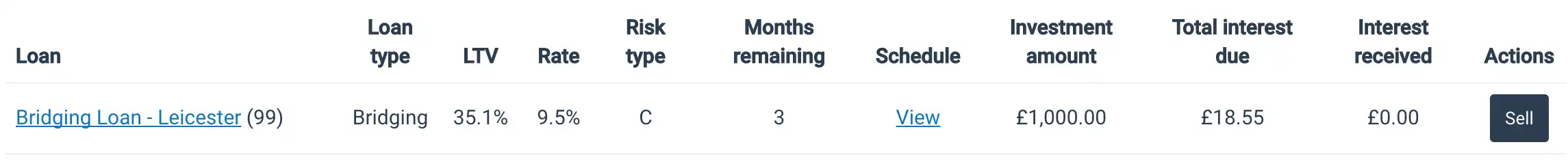

Once purchased, the loan part will appear alongside other investments in the buyer’s “My Investments” tab.

In a change to the functionality described in our previous blog post, daily accrued interest from the seller will not be added to the sale price.

In a change to the functionality described in our previous blog post, daily accrued interest from the seller will not be added to the sale price.

The sale price will be the principal amount of the loan part being sold. Any daily interest accrued will be reflected with an addition to the next interest payment due to the seller and a reduction to the first interest payment due to the buyer.

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL