With uncertainties around the UK housing market, as well as the broader interest rate environment, it’s easy to see why many property investors/developers have shelved or been reluctant to pull the trigger on a significant number of projects.

Recently however there have been signs of green shoots. In the last few weeks there has been broad coverage in the UK press of more positive data, including that from surveys by RICS, reports by Nationwide, and updates from the ONS.

The following were published in the ONS’s March and April bulletins, respectively:

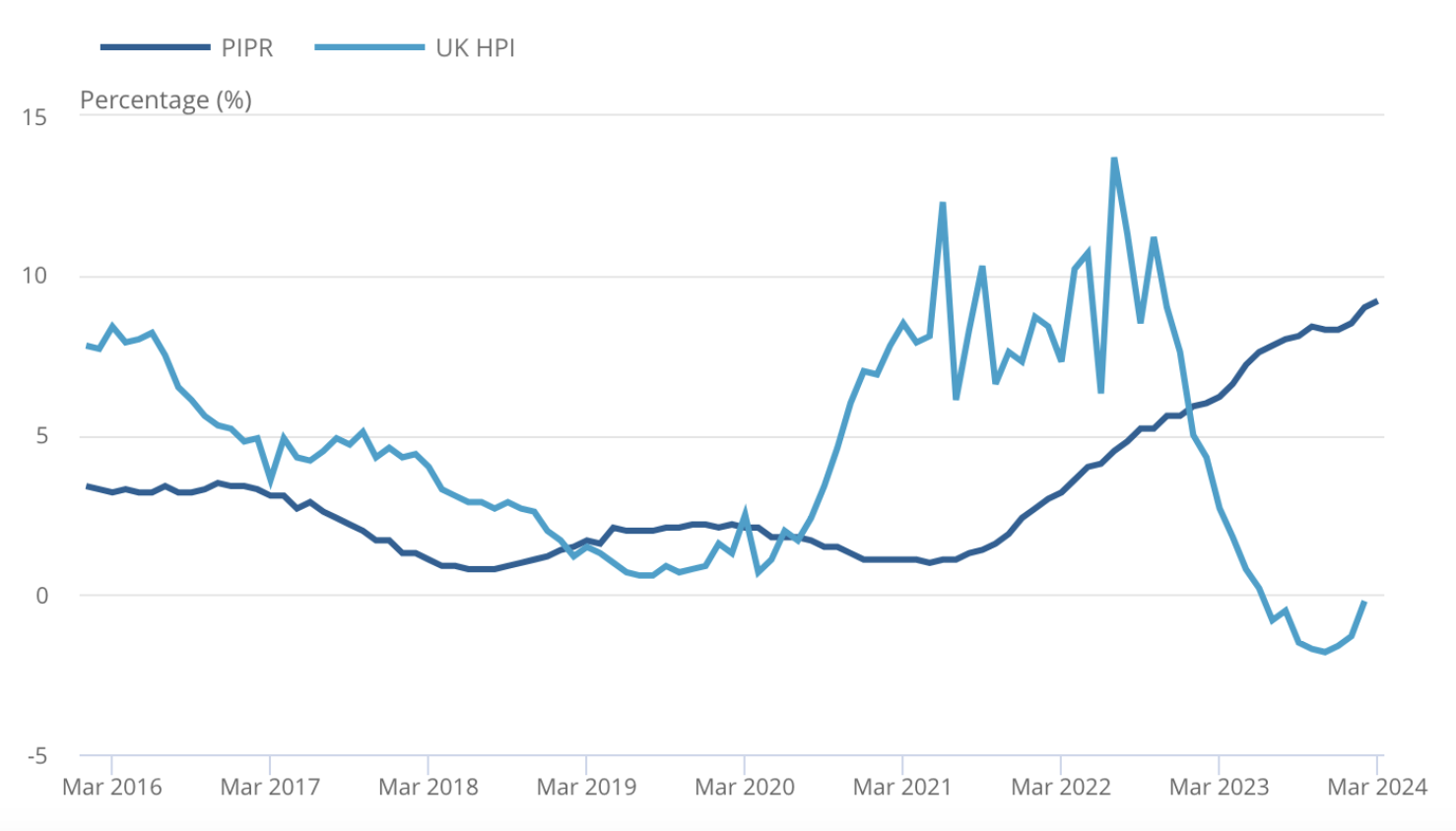

Whilst we know better than to try and time the market or declare that “the bottom is in”, you can see from the chart below that now could be a very good time to embark on new, or revive existing, property investment projects. All the while rents are rising, which is great for professional landlords.

Private rent and house price annual inflation

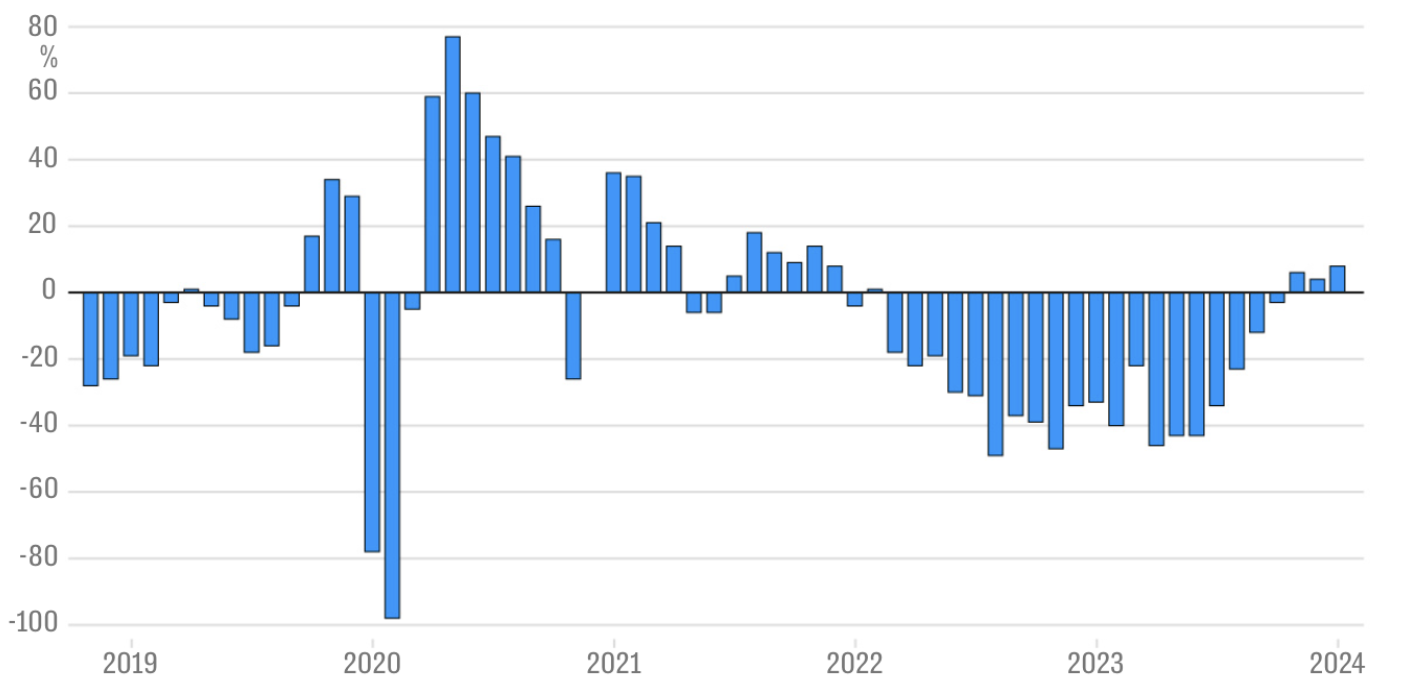

Private rent and house price annual inflationData from RICS (see below) shows the downward trend in new buyer enquiries is starting to reverse, after nearly two years of stagnation. This is something the LandlordInvest team have also experienced as 2024 has progressed.

New buyer enquiries

New buyer enquiriesIt’s not just the price of property and land that property investors need to consider when planning a project. Materials and labour are an important part of costing, and may set you back more in the near future as the economy gets back on track. Once investor confidence returns, availability for the best contractors will go down, and fewer discounts will be offered by suppliers.

Now could be the perfect time to strike especially good deals with overstocked suppliers and underbooked contractors.

Some things never change, and location is as key as ever to the success of a project. Investors should be wary of missing out on prime opportunities that present themselves due to taking an overly wait and see approach to the market. Also, the time required to gain planning permission isn’t decreasing so in many cases it’s important to simply get the ball rolling as soon as possible.

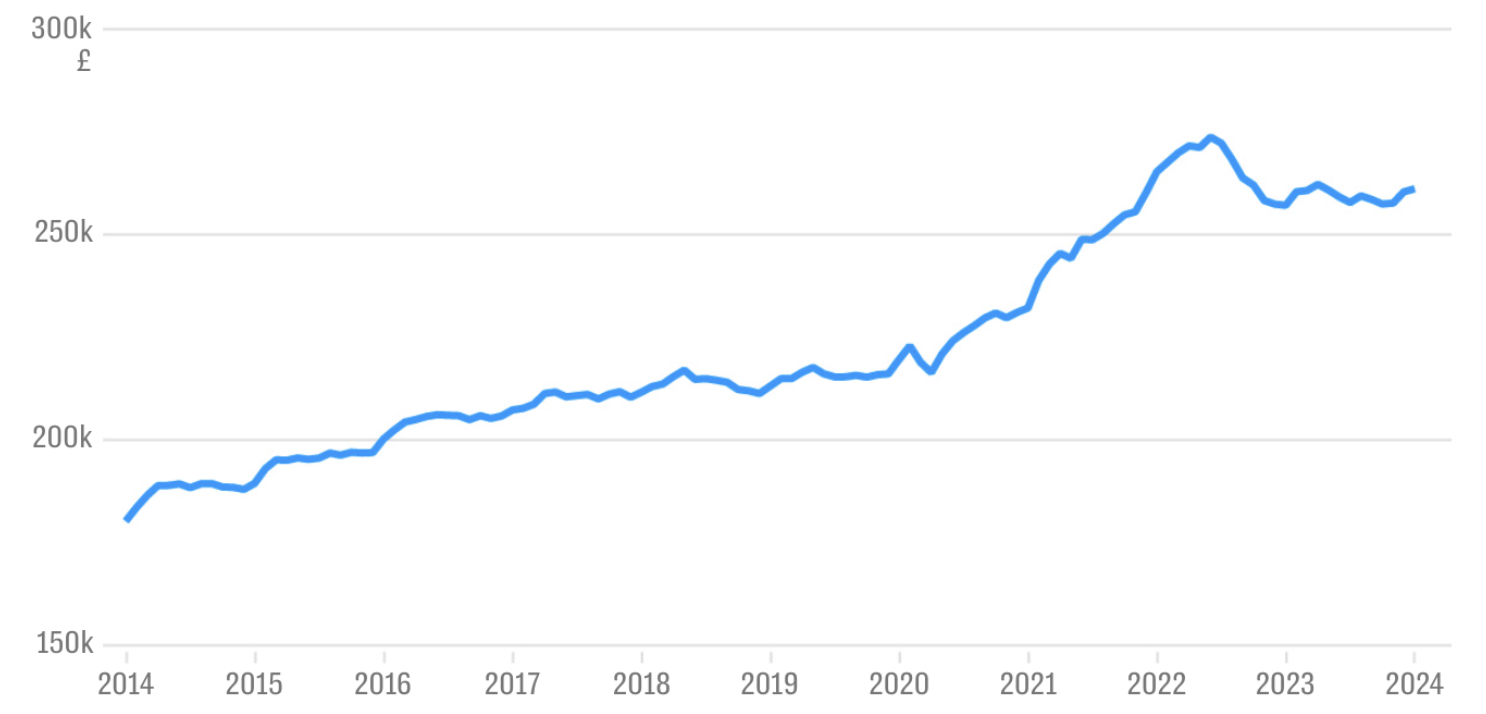

It can be easy to focus on too narrow a time frame, but the more we “zoom out” on data such as the average value of a home in the UK, we can see that despite the rate of increase changing and even reversing sometimes, the broader trend is still upward.

Average value of a UK home

Average value of a UK homeOur blogs are for information purposes only. This content is not financial, legal or tax advice. Should you require any advice in relation to the earnings you make from LandlordInvest we recommend seeking independent professional advice. Links to other sites are provided for your convenience but LandlordInvest accepts no responsibility or liability for the content of those sites or of any external site. The information in this blog is correct at the time of posting.

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL