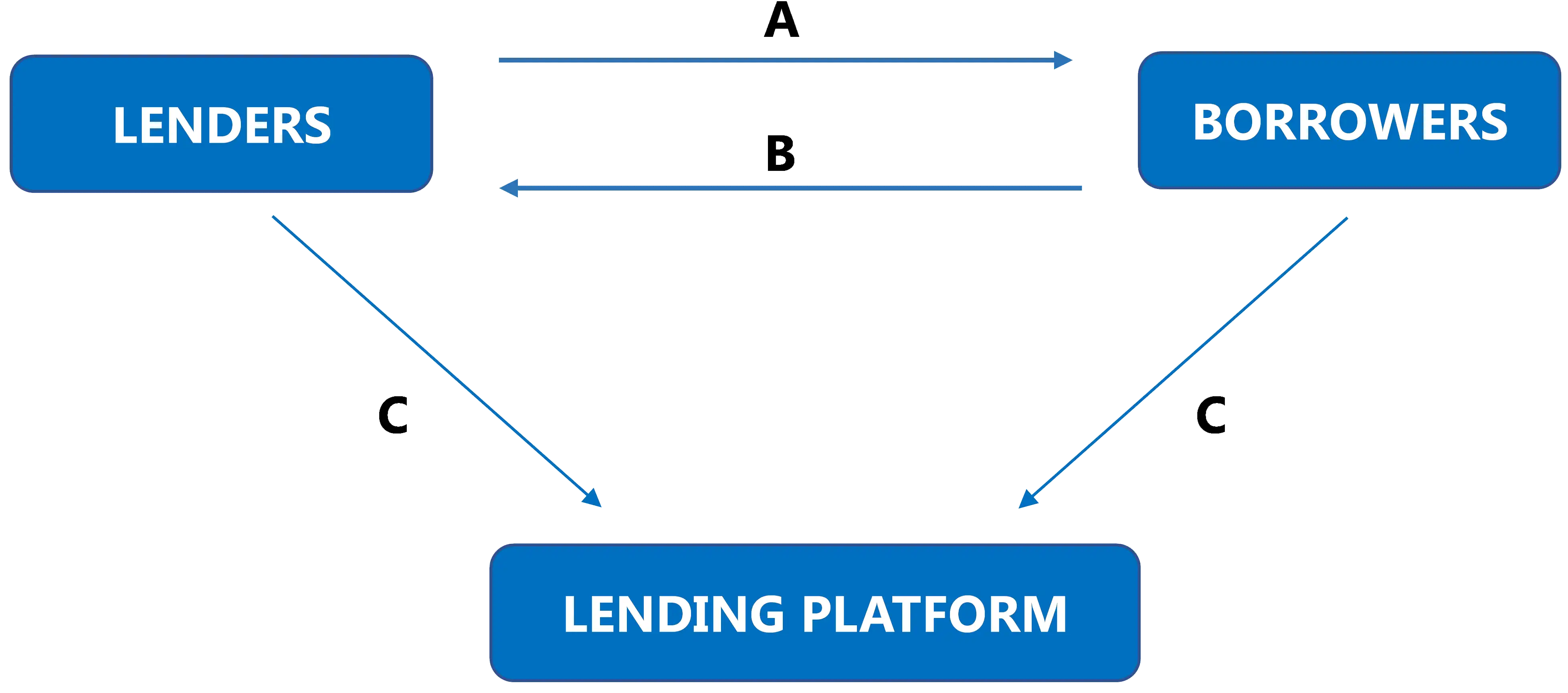

P2P lending is the practice of lending money to unrelated individuals, "peers", without going through a traditional financial intermediary such as a bank or other traditional financial institutions. Significant cost saving can be achieved by virtue of removing the middlemen associated with a typical loan transaction, such as brokers. This benefits both lenders, which are able to receive a higher rate on their money than keeping it in a bank account, and borrowers, that are able to raise financing quicker and cheaper than using traditional lenders.

This graphic provides a simplified overview of how P2P lending works:

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL