Following the interest in our previous comparison of Cash ISAs and LandlordInvest’s Innovative Finance ISA (IFISA), this post will focus on what a long-term investor could earn when investing £20,000 - an investors full ISA allowance in the 2023/24 tax year - through IFISAs offered by LandlordInvest and a variety of other popular peer-to-peer platforms.

Investors who take a long view stand to reap disproportionately more rewards than those with shorter horizons. Many readers will be aware that Warren Buffet attributes his wealth to compound interest (along with a nod to “living in America, some lucky genes”) or of Albert Einstein referring to compound interest as “the eighth wonder of the world”.

To that end, let’s look at the potential returns of £20,000 invested in a LandlordInvest IFISA over 5, 10, 20 and 30 years with interest earned reinvested and compounded annually.

10.76%* is the average rate of actual annual earnings by LandlordInvest platform investors in the previous five calendar years (2018 through 2022).

Due to the tax-free** nature of the ISA wrapper there are no deductions to be made for capital gains tax (CGT) or any other type of tax.

* Past performance is not a reliable indicator of future results. Returns are not guaranteed.

** Tax treatment depends on individual circumstances and may change.

After only five years, the effects of compound interest are already evident in earnings of £13,338 against an initial investment of £20,000. However, it’s the longer term investments that begin to see really outsized earnings for the patient investors with 10, 20 and 30 years; earning £35,572, £134,415, £409,060 respectively.

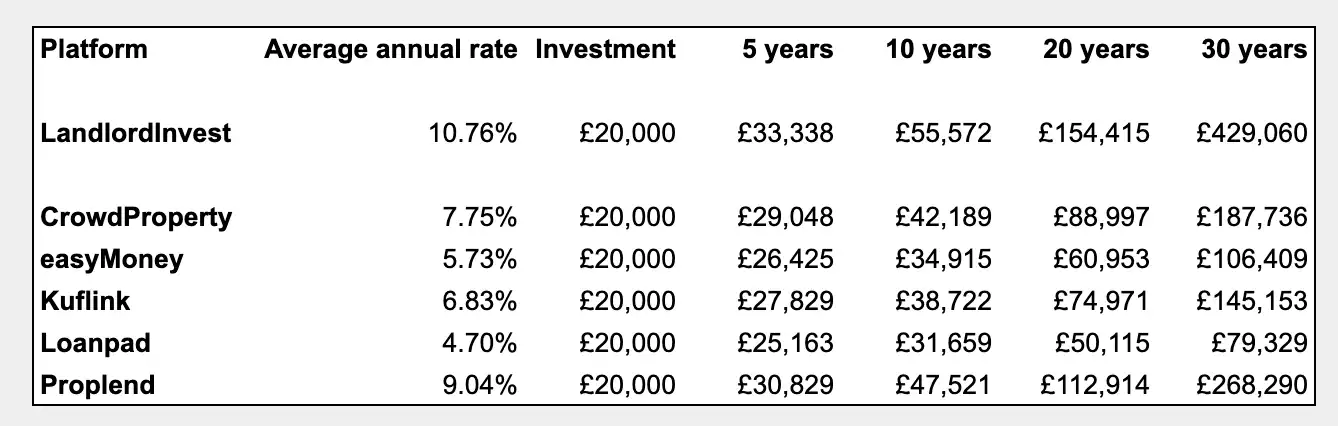

For comparison, let’s also look at what other IFISAs could yield in the same circumstances*.

* More information about the data sources are available at the end of this post

After as little as five years, LandlordInvest investors would earn £8,175 (+32.5%) more than the lowest yielding platform compared. Nonetheless, for the longer term investor the difference grows to £349,732 (+440.1%) at the 30 year horizon.

When compared to the highest yielding other platform, LandlordInvest investors would earn a smaller premium of £2,509 (+8.1%) after five years; but over 30 years the difference swells to a very meaningful £160,770 (+59.9%).

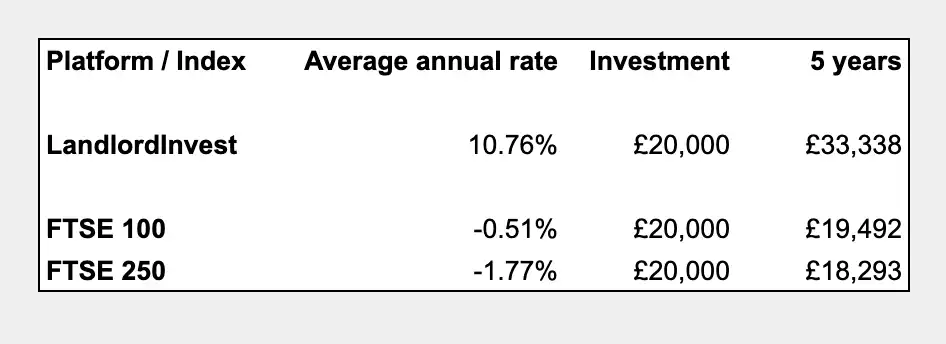

As a side note, it’s worth noting that all peer-to-peer platforms mentioned have, on average and over the past five years, outperformed both the FTSE 100 and 250 indices which both recorded losses during the same previous five calendar years (2018 through 2022) used in the calculations of LandlordInvest’s average annual return above.

Please note that this post does not account for inflation, meaning that the gains of the platforms would be reduced and the index losses worsened, in real terms.

Data sources

Actual platform investor rates for CrowdProperty, Loanpad, and Proplend were obtained from Outcomes Statements published by the companies in accordance with FCA rules. Data for easyMoney and Kuflink was obtained from their website statistics pages:

Average actual investor rates were calculated using data from the previous five years for CrowdProperty, Kuflink, and Proplend; and for four years for easyMoney and Loanpad.

Where multiple products for one platform were available, the rate of a product comparable to a LandlordInvest account was used. In the case of easyMoney these were “Premium v1 & v2”, and in the case of Kuflink it was “Self Invest”.

Our blogs are for information purposes only. This content is not financial, legal or tax advice. Should you require any advice in relation to the earnings you make from LandlordInvest we recommend seeking independent professional advice. Links to other sites are provided for your convenience but LandlordInvest accepts no responsibility or liability for the content of those sites or of any external site. The information in this blog is correct at the time of posting.

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL