Having been the only P2P platform in the UK to voluntarily publish its entire loan book since inception, it’s fair to say we at LandlordInvest embrace openness with our data. The P2P lending industry can be very opaque, so we try to do everything we can to share with and inform both our platform lenders and the broader community.

Today we’d like to share an analysis of the various outcomes of platform loans by the risk rating that we originally assigned when publishing the loan listings for funding. We analyse all loans originated on the platfrom since we started trading in 2017 to today.

At LandlordInvest we follow a proprietary rating system which focuses on our “Three Cs” (Capacity, Character and Collateral). You can read about it in detail here: How we assess borrowers.

LandlordInvest strives to offer quality risk-adjusted returns for investors who can choose which risk category, typically with higher interest rates for lower ratings, to invest funds in line with their personal risk appetite.

With a wealth of historic platform data available, we are able to review how loans with different risk ratings performed post-funding.

We’ll focus on loans that have, at least once since being funded, received one of the non-performing loan statuses. The FAQ post explaining these is our most visited FAQ page, so it’s clearly of interest to lenders.

There are three non-performing statuses:

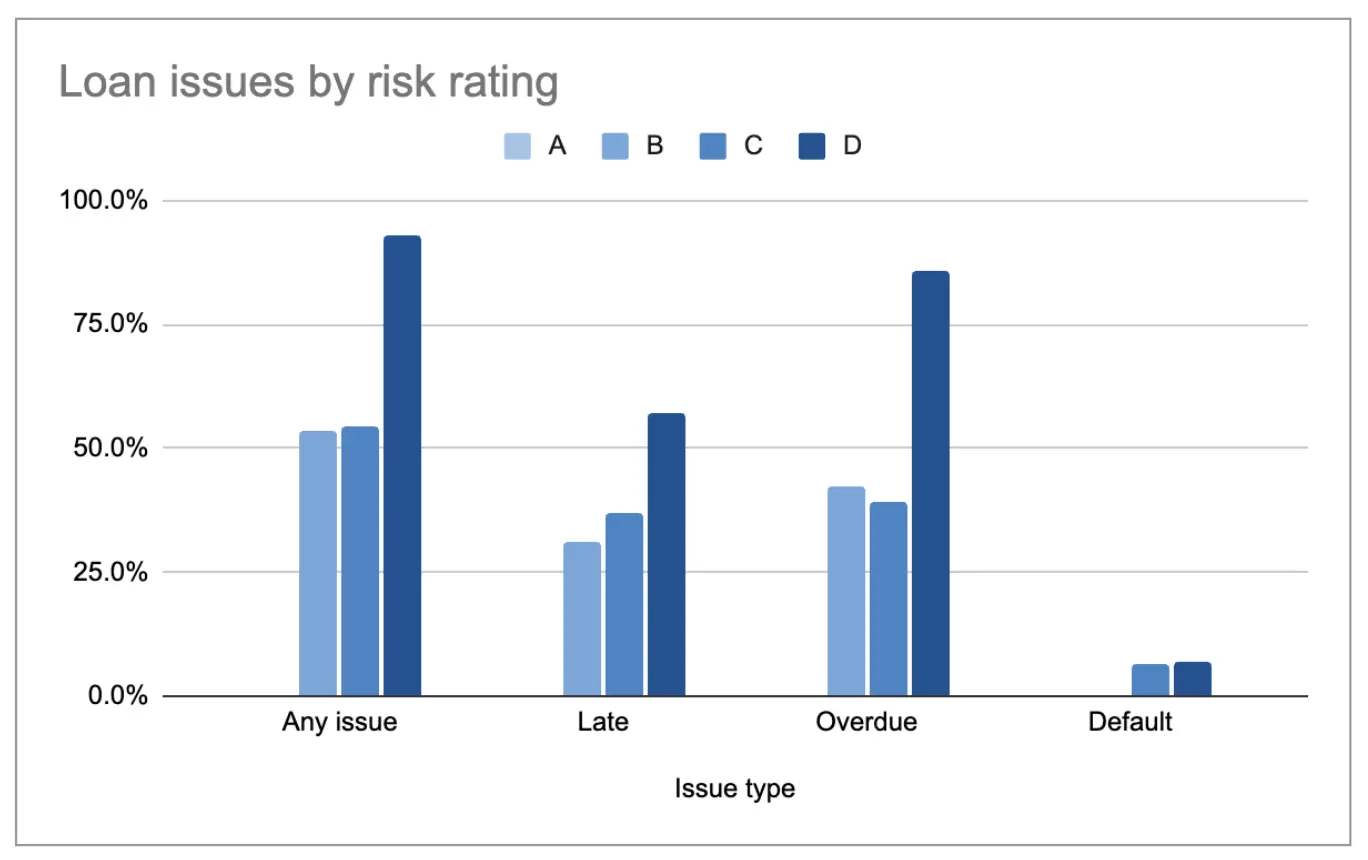

| Risk rating | A | B | C | D |

| Loans 1 | 0.9% | 42.5% | 43.4% | 13.2% |

| Loan amount 1 | 0.8% | 43.0% | 45.0% | 11.2% |

| Any issue 2 | 0.0% | 53.3% | 54.3% | 92.9% |

| Late 2 | 0.0% | 31.1% | 37.0% | 57.1% |

| Overdue 2 | 0.0% | 42.2% | 39.1% | 85.7% |

| Default 2 | 0.0% | 0.0% | 6.5% | 7.1% |

| Repaid early/on time 3 | 100.0% | 51.3% | 55.6% | 18.2% |

| Extended 2 | 0.0% | 46.7% | 41.3% | 42.9% |

| Average rate (weighted) | 5.0% | 8.4% | 11.7% | 14.5% |

| Average LTV (weighted) | 40.4% | 56.3% | 68.4% | 73.7% |

1 Percentage of the platform’s total loan book

2 Percentage of loans in that risk rating

3 Percentage of all repaid loans from that risk rating

Multiple tranches of development loans are counted as one loan. Data correct as of 15 May 2024.

It’s not surprising that risk rating A has a 0% history of any issues and a 100% record of being repaid on time. However, the majority of LandlordInvest’s lending takes place in the B and C categories, with some also in D.

As you might expect, there is a general trend of lower rated loans having more - including more serious - issues. Loans with risk rating D have experienced some sort of issue 92.9% of the time, and only repaid on time in 18.2% of cases, much less than B and C which both repaid on time more than 50% of the time.

It’s possible that LandlordInvest’s platform lenders don’t mind that some loans are repaid in full after their original maturity date as they still receive interest during this time, and in some cases a part of that interest may be paid at a higher rate due to penalty interest charged to temporarily delinquent borrowers.

It should be noted that loans in default have either gone on to be repaid in full, or are currently still being dealt with by our team, and that at the time of writing there has been no capital loss on any platform loans.

A large percentage of loans in categories B, C, and D have been extended at least once. In some cases, these extensions were longer (6-12 months, often in conjunction with partial capital repayment) in response to special economic circumstances such as COVID as we deliver on our responsibilities to both lenders and borrowers. Other extensions might be made when there are no particular issues with the loan. For example, a borrower with a performing loan might contact us prior to maturity to let us know about delays in refinancing or sale of a security property, we would then review the situation and potentially offer an extension.

Our blogs are for information purposes only. This content is not financial, legal or tax advice. Should you require any advice in relation to the earnings you make from LandlordInvest we recommend seeking independent professional advice. Links to other sites are provided for your convenience but LandlordInvest accepts no responsibility or liability for the content of those sites or of any external site. The information in this blog is correct at the time of posting.

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

LandlordInvest Limited is authorised and regulated by the Financial Conduct Authority (FCA) (FRN 660926). LandlordInvest Limited is not covered by the Financial Services Compensation Scheme (FSCS).

Loans provided to borrowers through LandlordInvest are provided solely for business purposes. Loans are therefore not regulated by the Financial Services and Markets Act 2000 or the Consumer Credit Act 1974. You should seek independent legal advice if you are in any doubt as to the consequences of the loan not being a regulated agreement under those Acts.

LandlordInvest Limited (Company No. 09245725), registered office 330 High Holborn, London, WC2A 1HL